Despite a turbulent 2020, the smart homes market is poised for exceptional growth as the industry aims to bring intelligence to ?not-so-smart? smart homes, according to research group Omdia.

The expansion beyond traditional retail channels and traditional use cases such as security will be achieved through partnerships and new technologies, ranging from Matter to Wi-Fi/radar sensing and edge-based systems that are deeply integrated into homes and buildings.

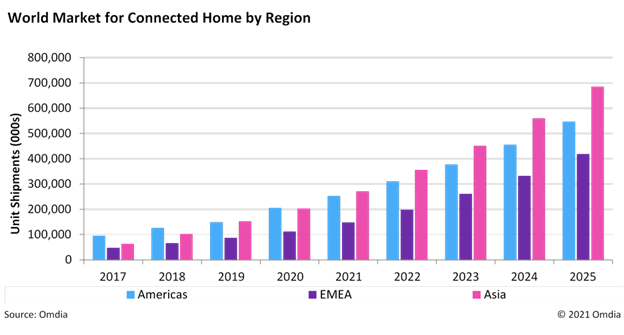

As a result of this new focus, the global smart home market ? worth an estimated $60.8 billion in 2020 ? is projected to exceed $178.5 billion in 2025, representing a compound-annual growth rate (CAGR) of 24.1% from 2020 to 2025. In terms of penetration, Omdia estimates 19% of broadband households globally had a smart home device in 2020, up from 10% in 2017.

?Only a couple of years ago, the smart home market seemed to have reached peak adoption due to complexity, cost and “walled gardens” that discouraged broader market penetration,? said Blake Kozak, senior principal analyst, Omdia.

?But by embracing opportunities outside proprietary solutions and use cases, the industry has fostered growth in new channels that are helping to postpone the inevitable slowdown in the industry.

?Once suffering from tunnel vision, brands are embracing a purpose-driven approach based on innovation, collaboration, and focus, which has led to the development of new channels such as homebuilders and apartments. From a technology perspective, Matter, while delayed until mid-2022, remains the cornerstone for the new smart-home paradigm that will facilitate the dissemination of devices and services to a new customer base.?

New Channels for Smart Home

Smart apartments and single-family home builders will have the greatest impact on the smart home over the next few years, especially in the US. In 2020, 2.4 million smart devices were shipped for smart apartments globally, which is forecast to increase to 64.7 million annual device shipments in 2025, at a CAGR of 59.5%. In terms of the installed base, Omdia estimated there were about 5.07 million smart-apartment devices installed globally, increasing to 149.8 million installed base in 2025.

For homebuilders in the US, Omdia estimates there were about 1.08 million new single-family homes built in 2020, of which about 49,000 had smart home features installed during construction. Omdia estimates this equated to more than 600,000 smart home devices installed during the construction of homes in the US in 2020. In 2025, there will be about 13 million devices installed annually with new home construction in the US.

Although homebuilders and multifamily have been on the radar for smart homes for many years, these two channels were not highly pursued by smart home brands or service providers until mid-2020. Now, globally, these two channels are predicted to combine for more than 75 million smart home device shipments in 2025, or about 15% of total smart home shipments for that year.

Omdia is a leading internationalinformation and communications technology (ICT) research group. With clients operating in over 120 countries, Omdia provides market-critical data, analysis, advice and custom consulting.

Source: informa.com