Although Avigilon Corporation (AVO.TO) recently reported their financial results for the six months ending June 30, 1016, it hasn’t been well received for the Toronto-based security solutions provider. In order to achieve those record revenue figures, the company had to slash prices on many of its popular products. This means much lower operating margins and their earnings per share are half of what they were last year. Much of this is in direct response to Chinese companies, such as Hikvision and Dahua, taking a larger share of the market with a low-price strategy. Therefore, Avigilon has had to make some significant price adjustments to remain a market contender.

Here is the information provided in a recent release by Avigilon. All figures are in United States (“US”) dollars unless otherwise stated.

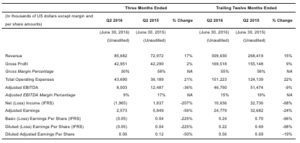

Second Quarter 2016 Financial Highlights

- Record revenue of $85.7 million , an increase of 17% over Q2 2015 revenue of $73.0 million , reflecting greater customer adoption in existing markets, further penetration of new target regions, sales of new products, and the Pricing Adjustment (as defined below).

- Gross profit was up $0.7 million , compared to the same period last year, primarily due to increased sales volume.

- Gross margin percentage was 50%, compared with 58% in Q2 2015, primarily due to the Pricing Adjustment.

- Adjusted EBITDA* was $8.0 million , compared with Q2 2015 Adjusted EBITDA of $12.5 million .

- Adjusted Earnings* were $2.6 million , compared with Q2 2015 Adjusted Earnings of $5.8 million .

- Diluted Adjusted Earnings Per Share* of $0.06 , compared with $0.12 in Q2 2015.

“We’ve increased revenue for the 34th consecutive quarter on a year over year basis, captured additional market share and continued to invest for growth,” said Alexander Fernandes , Avigilon’s Founder, President, Chief Executive Officer and Chairman of the Board. “To expand our addressable market, we reduced prices on our H3 camera line and select NVRs and achieved record overall unit sales and revenue. This adjustment also increased cash flow from operations and benefited gross profit dollars at the expense of gross margin as a percentage of revenue. Over time, we expect gross margin to increase due to greater economies of scale, and growing revenues from patent licensing and video analytics.”

“To support long-term growth we continued to invest in every department, notably in sales and marketing, manufacturing capabilities, and research and development. We’re advancing our video analytics, such as our recently announced Avigilon Appearance Search technology, and plan to launch several new exciting video analytics-enabled products in the coming weeks.”

Second Quarter 2016 Business Highlights

- Announced Avigilon Appearance Search video analytics technology, a sophisticated search engine for video data.

- Avigilon’s year over year sales growth outpaced that of the industry.

- Successfully completed the Early Adopter Plan for the Avigilon Patent License Program, adding eight new licensees to the Program.

- Implemented a new enterprise resource planning system to help ensure effective scalability.

Summary of Second Quarter 2016 Financial Results

Detailed Financial Review

Avigilon reported Q2 2016 revenue of $85.7 million , an increase of 17% over revenue of $73.0 million in Q2 2015. On a constant currency basis, revenue in Q2 2016 grew by 18% over the same period in 2015. Revenue growth reflects increased sales driven by greater customer adoption with year over year sales growth in all geographic regions, further penetration of target regions, sales of new products such as the H4 and H4 ES camera lines, and the Pricing Adjustment (as defined below). In the second quarter of 2016, Avigilon reduced prices on the H3 camera line and select Network Video Recorders (the “Pricing Adjustment”) to drive unit sales and revenues, expand addressable market and capture additional market share. The Pricing Adjustment resulted in increased cash flow from operations and benefited gross profit at the expense of gross margin as a percentage of revenue.

Gross profit was $43.0 million in Q2 2016 compared with $42.3 million in Q2 2015, an increase of $0.7 million . The increase was primarily due to overall increased unit sales as a result of the Pricing Adjustment, in addition to strong unit sales of the H4 and H4 ES camera lines. As a percentage of revenue, gross margin percentage in Q2 2016 was 50% compared to 58% in the prior year primarily due to the Pricing Adjustment. Over time, the Company expects gross margin to increase due to greater economies of scale, and increasing revenues and sales from patent licensing and video analytics. Separately, gross margin percentages may fluctuate quarterly due to changes in product mix, pricing, and foreign exchange rates.

Sales and marketing expenses in Q2 2016 were $20.5 million , an increase of 15% compared with $17.9 million in Q2 2015. The increase in Q2 2016 reflects investments to expand the Company’s global sales and marketing team and initiatives, which management believes will drive continued revenue growth. In Q2 2016, sales and marketing expenses represented 24% of revenue, compared with 25% of revenue in Q2 2015.

Research and development (“R&D”) expenses, net of related income tax credits and capitalized development costs, were $4.6 million in Q2 2016, compared with $2.7 million in Q2 2015. Gross R&D expenses were $8.4 million in Q2 2016 (10% of revenue), compared with $5.9 million in Q2 2015 (8% of revenue), an increase of 43%. The increase in R&D expenses are consistent with the Company’s ongoing plan to further enhance and expand upon its product offerings and intellectual property portfolio.

General and administrative (“G&A”) expenses in Q2 2016 were $13.3 million (or 16% of revenue), compared with $12.1 million in Q2 2015 (or 17% of revenue). The $1.2 million increase was primarily due to additional personnel and their related expenses to support business growth. Management expects the Company’s G&A expenses to increase in the near term as the Company continues to invest in infrastructure to support planned growth, but that these expenses will increase at a slower rate than revenue over time.

Source: